Debtors’ attorneys: This post addresses three issues: (1) the Debtor Handbook; (2) a new letter going to debtors at confirmation; and (3) more specific information about your clients’ obligations to pay post-confirmation tax refunds or bonuses or to provide documents.

Debtor Handbook: I revised the Debtor Handbook to make it more concise and readable. I like giving paper copies to debtors at the 341 and will continue to do that. A PDF version of the new Debtor Handbook is available by clicking here or going to the main website.

New Letter to Debtor at Confirmation: We are now sending a letter to the debtor when a plan is confirmed. The letter:

- gives the debtor a full payment schedule so they know when their plan payment is expected to change;

- tells the debtor if they will need to provide documents such as paystubs or tax returns during the life of the plan;

- tells debtors if they will need to make payments from tax refunds, bonuses, or other lump sum payments; and

- informs debtors that they need to call their attorney if they have any questions.

The letter is mailed when we serve the order confirming and is attached to the certificate of service in ECF. Click here to see a sample letter to debtor at confirmation.

Post-Confirmation Requirements for Tax Refunds, Bonuses, Documents, etc.: Many debtors are required by the confirmed plan to:

- Provide copies of tax returns

- Provide year-end paystubs

- Provide bonus paystubs

- Pay tax refunds

- Pay bonuses

- Pay lump-sum surplus income

We send a reminder letter to those debtors in early January (click here to see a sample) and a follow-up letter in May. These reminder letters, like the new letters we send at confirmation, will now specify the debtor’s obligation to provide documents or to make additional payments. The due date is usually May 1. We begin filing motions to dismiss for noncompliance after May 15.

The motion to dismiss for failure to pay tax refunds or bonuses or to provide required documents will also reflect more specific information. For example, the revised motion to dismiss will state that the debtor failed to comply with the terms of the confirmed plan directing the debtors to: “Pay some or all tax refund income to the trustee. Debtor must pay Any amount over $3,000.”

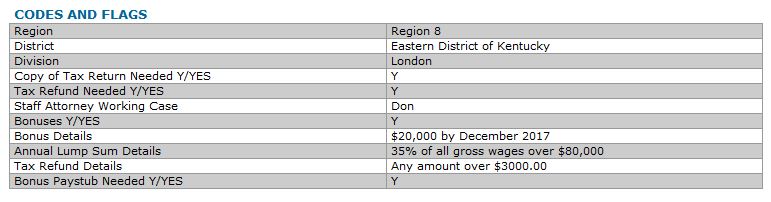

New Information on the 13network: The best news for debtors’ attorneys is that you can now see this information on the 13network. When you select a case, it opens on the “profile” tab. There, you will see a block of data called “Codes and Flags.” This is what it looks like (for now):

Hopefully I can rearrange the fields so they are more logically listed, but – baby steps . . . .

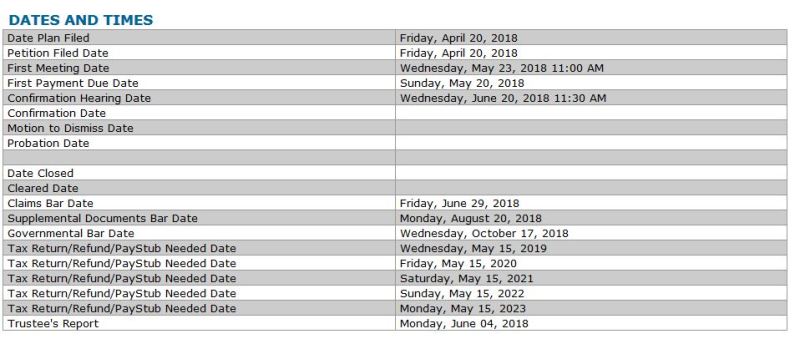

You also need to look at the section called “Dates and Times” for “Tax Return/Refund/Paystub Needed Date.” That will list the dates after which we will file motions to dismiss for noncompliance. It looks like this:

Some debtors have to pay bonuses more frequently than once a year. Those deadlines will not show up in any field. Instead, the “bonus details” might say something like “33% of the gross bonus,” and it is up to the debtor to send us the bonus on receipt. Staff have the bonus deadlines tickled and will file motions to dismiss if the deadline passes and we have not received a bonus payment or a paystub showing that no bonus has been paid.

Unfortunately, none of this new information is visible to debtors on the NDC, but I hope we can make it available in the future.

P.S. I have a statutory duty to “advise, other than on legal matters, and assist the debtor in performance under the plan.” I can ethically communicate with a represented party when authorized to do so by law or court order (I note this because my last post raised the ethical problems of using “reply to all” in emails).